06.01.2019

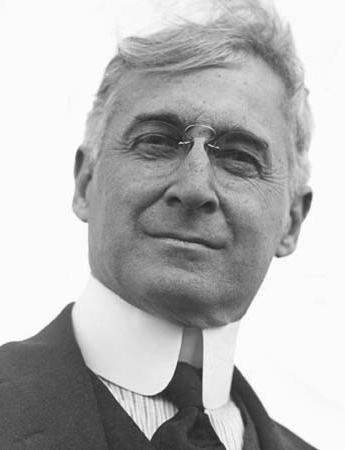

Bernard M. Baruch. My own life

◊ The rating is calculated based on the points awarded for last week

◊ Points are awarded for:

⇒ visiting pages dedicated to the star

⇒ voting for a star

⇒ commenting a star

Biography, life story of Bernard Baruch

Bernard BaruchBernard baruch

Date of birth: 08/19/1870 [South Carolina]

Date of death: 06/20/1965

USA (USA)

American financier, stock speculator and political consultant. Having succeeded as a businessman, he began to advise US presidents on economic issues Woodrow Wilson (Woodrow Wilson) and Franklin Delano Roosevelt.

Bernard Baruch was born in Camden, South Carolina (Camden, South Carolina), in the family of Simon (Simon) and Belle Baruch (Belle Baruch). His father was an immigrant from Germany, of Jewish origin; he moved to the States in 1855. During the American Civil War, he was a surgeon on the staff of renowned Confederate General Robert E. Lee; in addition, he became one of the pioneers and founders of physiotherapy. According to Bernard's autobiography, Simon Baruch was also a member of the Ku Klux Klan - back in the days when anti-Semitic sentiments in this movement were weakly expressed.

In 1881, the Bernard family moved to New York ( New York City); Eight years later, Baruch graduated from City College of New York. After graduation, Bernard moved to brokers; after a while he rose to the position of a partner in "A.A. Housman & Company". For $ 18,000, Baruch bought himself a place on the New York Stock Exchange; by the age of 30, he had already made himself a solid fortune - mainly by speculating in sugar. In 1903, Bernard opened his own brokerage firm; he categorically refused to join the already existing financial firms, thus earning himself a reputation as a sort of "lone wolf of Wall Street." By 1910, Baruch was already one of the country's most famous financiers.

During World War I, Bernard advised US President Woodrow Wilson on national security issues; At that time he held the post of chairman of the Council of the military industry (by the way, he was stenographed by the then unknown Billy Rose, the future poet and impresario). Baruch rendered big influence to turn the American economy on a war footing. By the end of the war, Bernard attended the Versailles Peace Conference with Wilson.

Financier and investor Bernard Baruch was known for his big capital and serious political influence... Having achieved success on the New York Stock Exchange, he began to work as an advisor to US presidents. His life is an amazing kaleidoscope of events and surprises.

early years

The famous financier Bernard Baruch was born on August 19, 1870 in the American city of Camden (South Carolina). He came from a poor Jewish family. Simon Baruch fathered four sons, the second of whom was Bernard Baruch. Children, as time has shown, turned out to be talented and hardworking. The brother of the future financier Herman even worked as the American ambassador to the Netherlands and Portugal.

Bernard's early years were during the Reconstruction period, when a wave of crime and black riots swept over the post-Civil War. In search of a quiet corner, the Baruch family moved to New York. Here Bernard went to college.

Baruch's first place of work in 1890 was the brokerage firm A. A. Housman & Co. The twenty-year-old was an errand boy who earned $ 3 a week. Other opportunities for self-realization due to social status and he simply did not have a nationality.

Takeoff

Like many other brokers, Bernard Baruch came to the exchange by accident. His first experience was a failure. However, Baruch did not give up. He started borrowing money from friends and family. At some point, his father told him that the $ 500 donated was all that was left at home for a rainy day. Bernard was not scared and, taking the risk, began a dizzying career on Wall Street.

Baruch did not fit into the usual picture of the stock exchange at all. He did business in a rather extravagant way: he entered into risky contracts, plunged into speculation. The professionals took the first successes of this upstart with hostility. The famous banker and financier of his time, John Pierpont Morgan, considered Baruch a “card sharper”. It is wrong to think that under capitalism all entrepreneurs earned their capital with white gloves. J.P. Morgan himself was not the cleanest. However, the methods with which Bernard Baruch armed himself surprised even the most notorious schemers.

Swindler

From its very appearance on the stock exchange, the future conqueror of Wall Street abandoned the then popular trading strategy. Baruch never absorbed weak companies for the purpose of their subsequent resale. In addition, he did not resort to artificially raising the prices of his shares. The investor did not, as was customary, take into account the fundamental factors of the stock market with scrupulousness.

Despite the fact that the trades were on the rise then, the financier was actively playing for a fall. For himself, Bernard Baruch formulated the simplest rule: "Selling at the maximum and buying at the minimum is impossible." As a consequence, he often went against the market trend, bought when many were selling, and vice versa.

Towards wealth

Most of all, Baruch's style was similar to that of another famous speculator Jesse Livermore. These two traders were known to periodically leave the market and wait for the best moment to resume trading. Once, having made such a difficult decision for a stock player, Bernard said: "Jay, I think it's time to go and shoot the partridges." After this remark, he sold all his positions and left for long rest to his Hobkau Baroni plantation in South Carolina. The estate's salty marshes and sandy beaches were teeming with ducks, and the 17,000 acres lacked a single telephone to reach New York. But even after the longest absence, the player returned to the exchange.

The eccentricity with which Bernard Baruch and Jesse Livermore scoffed at the generally accepted rules of traders made them famous even before the advent of big capitals. One way or another, but the growth of prosperity upstarts did not keep itself waiting.

Investor and businessman

Starting from the bottom, Baruch earned enough to start his own investments. One of the first to fund his money was Texasgulf Inc., which specialized in services for the booming oil industry.

But as shown further development events, the broker did not like to manage companies. His element was trade, to which he devoted most of his time on Wall Street. Already by 1900. the entire financial district of New York knew who Bernard Baruch was. The story of his success inspired many and frightened many. Rumors constantly arose about the huge fortune of the speculator. The scale of his figure became equal to the scale of Joseph Kennedy and J.P. Morgan.

"Lone wolf"

Today, the heirs of Bernard Baruch continue to enjoy the fortune amassed by their clever relative. In 1903, at the age of only 33, a recently unknown broker became a member of the millionaire club. All his thorny path on the New York Stock Exchange, Baruch passed completely alone. He loved to keep everything under control and could not stand collective action... For this, the investor was called "the lone wolf of Wall Street."

Over the years of his financial activity, Bernard Baruch has experienced many ups and downs. The biography of a financier is an example of a person who, despite everything, stubbornly heads towards success. in 1907, Baruch acquired the international trading company M. Hentz & Co., and already in mature age he began to prefer investments related to reliable real estate.

Public service

Having achieved significant success on the stock exchange and in business, Baruch began to look at politics. In 1912, he agreed to sponsor Woodrow Wilson's presidential campaign. The Democratic Party Foundation received $ 50,000 from a well-wisher. Wilson won the race and in gratitude appointed a financier to the Department of National Defense.

In his first public office, Bernard Baruch, whose photo began to appear in national newspapers, faced a serious dilemma. Combining political and business activities turned out to be extremely difficult.

Problems with law

At the exchange, Baruch began to be accused of abusing his own official regulations to obtain insider information about the market. Moreover, in 1917, the investor was accused of disclosing secret documents. Investigators concluded that using his position, he illegally earned about a million dollars.

In response to claims law enforcement Baruch stated that he received his last money on the sale in the same way as he did it before his appearance on public service... The defense was reinforced concrete - the speculator managed to get out of the water.

As an official, Bernard Mannes Baruch was responsible for the distribution of military orders. Then he left his native New York stock exchange. The financier stopped buying and selling, but continued his investing activity, redirecting it to the mainstream of the military industry. Baruch's money flowed into companies engaged in the production of various weapons and ammunition. Certainly, part of the dollar supply that went from the state budget to military plants remained in the pocket of the clever civil servant. According to various estimates, at the time of the defeat of Germany, Baruch was the owner of a fortune of 200 million.

In 1919, the leaders of the victorious countries gathered at Baruch also went to the French capital. He was part of the official American delegation led by President Wilson. The economic adviser opposed excessive contributions from Germany and supported the idea of \u200b\u200bcreating a League of Nations, necessary to stimulate cooperation between different states.

Baruch and the Great Depression

Resigned as president in 1921. Rotation in the White House did not prevent Baruch from staying on the political Olympus of the United States. He was an advisor to Warren Harding, Franklin Roosevelt and Harry Truman. Balancing between power and business, the financier continued to enrich himself using insider data on the state of the market. Bernard Baruch's heirs could have been left penniless if not for his timely agility. The day before, Baruch sold all his securities, and with the money received he a large number of bonds.

On October 24, 1929, the American collapsed. The entire market was in shock from the onset of the crisis and the uncertain future. All - but not Baruch Bernard. The book he wrote about himself at the end of his life says that on that day the speculator came to the New York stock exchange with Winston Churchill. The visit was not accidental. The financier wanted to demonstrate his enviable economic acumen to British politicians.

Speculation with gold and silver

One of the most lucrative machinations of Bernard Baruch was his chain of actions in 1933, when the United States abolished the gold standard. By that time, the country had been living in a terrible crisis for several years. She was agitated by the colossal unemployment and bankruptcies of the largest companies. In these conditions, the government announced the widespread purchase of gold from citizens. In exchange for the precious metal, people received paper money.

In October 1933, when most of gold was transferred to the treasury, President Roosevelt announced the devaluation of the national currency. Now the government was buying gold at an increased price. The closest adviser to the president, Bernard Baruch, knew about all the vicissitudes of the course change. Quotes from the press of that time clearly demonstrate that society was in a fever from frequent cardinal changes. And only the "lone wolf" skillfully took advantage of every new circumstance. He invested a significant portion of his money in silver just on the eve of the increase in the price of the government buyout of this metal.

The Second World War

AT last years life of Bernard Baruch, his political activity increasingly dominated over financial. With the outbreak of World War II, he again found himself in the role of a military-economic adviser to the American authorities. The investor made a significant contribution to changing the US tax system. In fact, he initiated the economic mobilization of the country. Such was the influence of the adviser that in 1944 President Roosevelt spent a whole month at his famous South Carolina estate.

The president even offered Baruch to head the US Military Industrial Production Committee. The adviser had long longed to be in this post and only for formality asked the doctor for a time to be examined in order to make sure of his own performance at the most important post. However, while Baruch was delaying the answer, another Roosevelt adviser, Harry Hopkins, persuaded the president to abandon this venture. As a result, at the decisive meeting, the first person withdrew his offer.

"Baruch's Plan"

In 1946, Truman, who replaced Roosevelt, appointed Baruch to the position of the US representative on the UN commission in charge of nuclear energy. In this capacity, the presidential adviser became widely known in the USSR. The fact is that at the very first meeting of the commission, Baruch proposed to ban nuclear weapons and make common body the work of all countries in the nuclear field. The package of initiatives became known as the "Baruch Plan".

With the outbreak of the Cold War, the issue of nuclear security became more and more urgent. The fear of atomic bombing was great, because just a few years ago, the United States tested this weapon in two Japanese cities, demonstrating the horrific consequences of using the latest warheads. Nevertheless, the restrictive American initiative was criticized in the Kremlin. Stalin did not want to end the nuclear race and did not intend to find himself in a position dependent on the United States. The Baruch Plan was rejected. UN influence was not enough to subdue international projects development of nuclear weapons.

Speaking of the Cold War, it should be noted that it was Bernard Baruch who gave life to this phrase, although, according to the widespread point of view, the expression "cold war" first appeared in Winston Churchill's speech. After leaving the UN, the already elderly adviser continued to work in the White House. He died on June 20, 1965 in New York at the age of 94.

"Synonymous with" gambler ". But in fact, this word comes from the Latin specular, which means "sniff" and "observe". A “speculator” is a person who observes the future and acts before this future comes, ”he said Bernard Baruch about stock speculations in the book "My History".

Bernard Mannes Baruch started his career as an errand boy in a brokerage office, earning $ 3 a week for this job. Soon he became a broker, and then a partner of A. Housman & Co. And seven years later, he already owned an eighth part of this brokerage firm.

Bernard was born in 1870 in Camden, South Carolina to Simon and Bell Baruch. He was the second of four sons. His father emigrated to the United States from Germany at the age of fifteen. He graduated from medical college, became a surgeon, was one of the founders of physiotherapy. Simon Baruch fought in the North-South war on the Confederate side under the command of General Robert Lee. Bernard's maternal Sephardi ancestors migrated to America in the 1800s.

Bernard was born shortly after the end of the Civil War. The devastated South, where conflicts between blacks and whites continued, and gangs roamed the roads, was not the best place for living. When Bernard was ten years old, the Baruch family moved to New York.

After graduating from New York College in 1889, Bernard started from the lowest position in the office. He ran with errands to banking institutions, being interested, meanwhile, in life Wall Street... In 1898, he bought with the help of a close seat on the New York Stock Exchange. The first experience ended in failure. Over and over again Bernard had to turn to relatives for help. Finally, his father told him that the family had only $ 500 for a rainy day. And it was with these 500 dollars that Baruch's movement upward began.

His behavior on the stock exchange seemed strange. Although he was then on the rise, Baruch often played short. In his opinion, it is impossible to buy at the low and sell at the high. And so he often went against the market, selling when many were buying, and vice versa. One of his famous aphorisms reads: "As soon as good news about the stock market reaches the front page of The New York Times, sell!"

For Baruch, Wall Street was "one long lesson in human nature." In general, he was very careful with rumors. “There is something in the inside information that seems to paralyze the rational forces of a person ... He will ignore the most obvious facts,” Baruch believed. As Bernard's fortune grew, so did his capabilities. He could already afford to go into private equity and co-founded Texasgulf Inc., a service provider for the then burgeoning oil industry.

In 1903, together with his brother Hartwig, Bernard opened his own company, Baruch brothers. By this time, Bernard, already a millionaire, had married Anna Griffin. Despite the flourishing practice of creating various trusts at that time in order to manipulate the market, Baruch conducted all his operations alone, for which he received the nickname "the lone wolf of Wall Street".

Here is a very interesting audio recording about him:

In 1907, he purchased 17,000 acres of land in South Carolina for $ 55,000, the Hobcaw Barony estate, hoping that in the event of another fall in prices on the stock exchange, this land would not leave him without a livelihood.

At the same time, the Baruch brothers bought the international trading company Hentz with offices on Wall Street, Paris, London, Berlin and other cities. Baruch became one of the financial leaders on Wall Street - a rare major took place without consulting him. He became such an influential force that the press began tracking his whereabouts. The newspaper reported: "One of the reasons that prompted traders to take a bearish (downward price movement) position was the rumor that Bernard Baruch was going on a short vacation."

With support in 1912 presidential election campaign Woodrow Wilson - he contributed 50 thousand dollars to it - the active entry of Baruch into political life began. A few years later, Wilson appointed him a member of the National Defense Council Commission and a member of the Allied Procurement Commission. This was his first public office. A few years later, Baruch retired and handed over the management of Hеntz to the brothers. One of them is Herman Baruch, doctor and banker, who later served as ambassador to Portugal and Holland.

However, his involvement in the distribution of military orders gave Bernard Baruch (then the chairman of the military industry committee) opportunities for enrichment. According to some reports, by the end of the First World War, Baruch owned shares in most factories that carried out military orders. It is believed that by this time his fortune had reached $ 200 million. After the end of the war, Baruch participated in the Versailles Peace Conference, its Supreme Economic Council.

Elected to a second presidential term, Woodrow Wilson made Baruch his personal economic adviser. Since then, US presidents have used Baruch's advisor services regularly. He was an advisor to Presidents Harding and Coolidge. During the presidency of Hoover (1929–1933), being his financial advisor, Baruch opposed the establishment of diplomatic relations with the USSR.

All his life Baruch studied human psychology. In 1932, in the foreword to Charles McKay's book The Most Common Misconceptions and Folly of the Crowd, he wrote that reading this book saved him millions: “Each person taken individually is quite reasonable and reasonable, but becoming a member of the crowd, he immediately turns into a fool ... The world knew crowds of vigilantes and crusades, influxes into banks demanding the return of deposits and fires, which, if people did not panic, could do without human casualties. Not so long ago, there was a "passion for crushing" when large groups young people learned to dance in unison, imitating lemmings (a group of rodents - Ed. note). "

When Baruch wrote this foreword, there was an absolute collapse. financial market, which began three years earlier - in 1929. Unrestrained then led to the growth of the Dow Jones to 381 points, which caused a surge in greed. Three years later, the index fell not to 300, not to 150, or even to 75, but to 41 points. Senseless greed has shown its downside. “I have always believed,” Baruch said about this deplorable situation, “that if even in the midst of the dizzying fall in the price of securities, we tirelessly repeated that“ twice two is still four ”, many evils would have been avoided. Likewise today, even in the most despondent moment, when many are beginning to wonder if there is a limit to falling, a suitable spell might be: "Twice two is still four."

At that time, they talked about Baruch's romance with Countess Inid Kenmair, later nicknamed Lady Killmore - "kill more." This nickname, practicing black humor, put into circulation Somerset Maugham: Three of her husbands died by a strange coincidence. The beautiful Australian woman, a talented artist and sculptor, was an excellent horsewoman and shot accurately. Rarely did she leave anyone indifferent. Baruch was 25 years older than her, but that did not stop them love affairlasting several years.

The Great Depression did not take Baruch by surprise: back in 1928, he sold all his shares and bought. On October 29, the famous "Black Tuesday" of Wall Street, in the midst of panic, Baruch appeared in the gallery for visitors to the New York Stock Exchange, along with Winston Churchill.

It is said that Baruch wanted to demonstrate to him his power over the market. The Great Depression threw the US economy back 30 years, towards the turn of the century. Franklin Roosevelt, who became president in 1933, announced a "New Deal" - an economic policy that was supposed to lead the country out of a severe crisis. And again Baruch was his adviser.

In the mid-1930s, the escalation of tensions in Europe sparked a heated debate about how the United States should act - to support one of the blocs or remain neutral. Baruch sensed the voters' alarm. Roosevelt promised the people: "As long as I remain president, I will guarantee American mothers that their children will never be sent to any war waged outside the United States," and indeed passed a neutrality bill through Congress.

In 1937, Baruch submitted to the Senate War Commission proposals for mobilizing industry in case of war. Speaking for the preservation of US neutrality in a future war, Baruch simultaneously insisted on strengthening military power and creating military-strategic reserves. After the attack of Nazi Germany on the USSR, he called for assistance to the Soviet Union. During World War II, Baruch's role did much to bring about the reconversion of the American economy. His efforts prepared him a place on the Nazi list of people sentenced to death.

The anti-Semites consider him one of the organizers of the mythical "world Zionist government", although Baruch was not a Zionist, and he considered himself, first of all, an American, and then a Jew.

As a special representative of Roosevelt, Baruch traveled to Great Britain more than once; he was connected by many years of friendship with Winston Churchill, who, when he came to the United States, more than once stayed at Baruch's house. The last president he worked with was Harry Truman. At the age of 75, Baruch headed the UN Atomic Energy Commission. The main task he considered the preservation of the US atomic monopoly. In 1946, at the first session of the commission, he announced his program. “Science has revealed one of nature's worst secrets. History teaches us that the horrors that weapons carry with them have never deterred people from using them. However, today in our hands is a weapon of such destructive power that there is simply no defense against it. "

Baruch put forward a plan to establish total control over all developments in the field of atomic energy, called the "Baruch plan". This plan caused a sharp rebuff from the representative of the USSR A. Gromyko - and was not accepted.

In 1947, Baruch resigned. But one day, I met Vyshinsky at one of the evenings and told him: “We are both fools. You have the bomb and we have the bomb. Let's take this matter under our control while there is still time, because while we are busy chatting, everyone else will sooner or later get themselves this bomb. "

The term "cold war" was first used by George Orwell, but Baruch is believed to be its author. Speaking to the South Carolina Legislature in April 1947, Baruch said, “Let's not be deceived. We are in a state of cold war.

In Washington's Lafayette Park or New York's Central Park, it was not uncommon to see a tall, slender, gray-haired gentleman. Baruch liked to make important appointments not in an official setting, but on a park bench. The park bench was said to replace his office. This became his kind of "brand": "an advisor on the bench in Lafayette Park."

Throughout his life, his favorite place was the Hobcaw Barony estate in South Carolina, bought in his youth. This place was his refuge, here he loved to hunt, came here almost every year in May. There he also spent May 1965. He died in June. He was 95.

New York College in Manhattan (Baruch College) is named after him - one of the largest and most famous higher business schools. On the college grounds there is a sculpture of Baruch sitting on a bench. Those who see her for the first time often have the illusion that next to them, on the bench, is a living person.

Bernard baruch(birth name)

USA

Baruch's active penetration into political life began in 1912. With his money, he supported Woodrow Wilson in his presidential company. Baruch contributed $ 50 thousand to the Democratic Fund. In gratitude for this, Wilson appointed him to the Department of National Defense. During the First World War, he became the head of the Military Industrial Committee (eng. War Industries Board) and played a key role in the reorientation of American industry for military needs.

After World War I, he served on the Supreme Economic Council of the Versailles Conference and was the personal economic adviser to President T. W. Wilson. After Woodrow Wilson, he remained a constant companion of Presidents Warren Harding, Herbert Hoover, Franklin Roosevelt and Harry Truman. During World War II, President F.D. Roosevelt appointed Baruch chairman of the rubber shortage committee. In 1943, Baruch became an advisor to the director of the military mobilization department, D. Byrnes.

Baruch's Plan

Additional Information

Bernard Baruch was the first in the world to use the term Cold War on April 16 in a speech to the South Carolina House of Representatives to refer to the conflict between the United States and the Soviet Union.

Notes

Literature

- Bernard Mannes Baruch, Bernard Baruch Baruch: My Own Story. - New York: Buccaneer Books, 1993 .-- 337 p. - ISBN 156849095X

Links

- Baruch's Plan - Bomb Destruction Attempts - washprofile.ru

Baruch's active penetration into political life began in 1912. With his money, he supported Woodrow Wilson in his presidential campaign. Baruch contributed $ 50 thousand to the Democratic Fund. In gratitude for this, Wilson appointed him to the Department of National Defense. During the First World War, he became the head of the Military Industrial Committee (eng. War Industries Board) and played a key role in the reorientation of American industry for military needs.

After World War I, he served on the Supreme Economic Council of the Versailles Conference and was the personal economic adviser to President T. W. Wilson. After Woodrow Wilson, he remained a constant companion of presidents Warren Harding, appointed Baruch the US representative to the UN Atomic Energy Commission (eng. United Nations Atomic Energy Commission ). At the first meeting of the Commission, on June 14, 1946, Baruch announced a plan for the total prohibition of nuclear weapons, which went down in history as the "Baruch Plan". It provided that all states conducting research in the nuclear field should exchange relevant information; all nuclear programs must be exclusively peaceful in nature; nuclear weapons and other types of weapons of mass destruction must be destroyed - in order to fulfill these tasks, it is necessary to create competent international structures that are obliged to control the actions of individual states. This plan also contained such items as the creation of an international Atomic Development Authority, it was supposed to transfer control over nuclear production to this agency and exchange research within it between countries. Moreover, the plan included the transfer of technological information on nuclear power to the United States. Agency control was to be carried out within the framework of international on-site inspections. The plan envisaged the introduction of a mechanism for monitoring the nuclear programs of the countries entering into cooperation through international inspections in the territories of these countries. The UN Commission on Atomic Energy was to become the central organ of this agency.

However, such a plan did not suit the USSR, since, if adopted, it would clearly slow down the USSR's movement towards creating its nuclear potential necessary to ensure own safety... This need became apparent after the US showed its power on August 6 and 9, 1945, when nuclear bombs were dropped on the cities of Hiroshima and Nagasaki with civilians. That is why Soviet diplomacy at the UN conference put forward the idea of \u200b\u200brefusing to use nuclear power... The "Baruch plan" itself is the Acheson-Lilienthal report, in which Baruch made two significant changes: to the international body for monitoring atomic energy the veto power of the permanent members of the UN Security Council would not be extended, and this body could also take coercive measures against violators of the control rules bypassing the UN Security Council. Such provisions were fundamentally at odds with the UN Charter and its structure, so the "Baruch plan" was not adopted. American diplomat and historian B. Bechhofer, who in the 1950s. he took part in the disarmament negotiations as part of the US delegations, said the following about this project: “The approach to the veto contained in the Baruch plan introduced negotiation process an extraneous and unnecessary element that allowed the Soviet Union to take a position through which it received substantial support outside its block. Baruch's position on the veto is an extreme example of his isolation from the general line of US foreign policy. "

At the same time, the United States went for broke: it offered other countries to abandon their nuclear weapons, provided that the United States undertakes an obligation not to produce them additionally and agrees to create an adequate control system. The plan was rejected by the USSR. The Soviet representatives explained this by the fact that the United States and its allies cannot be trusted. At the same time, the Soviet Union proposed that the United States also destroy its nuclear weapons, but this proposal was in turn rejected by the United States.

As a result, the plan was never adopted due to the Soviet veto in the Security Council. The commission ceased its activities in 1949. After the failure of the "Baruch Plan" and the reciprocal Soviet initiative, a nuclear arms race began in the world.